Oil and gas companies face a challenging environment today. They must operate more efficiently than ever while maintaining high safety and environmental protection standards. Oil and gas companies have always made use of technology, both physical and computational, but they have been slower than companies in other industries to adopt the latest wave of digital transformation. Many are missing an integrated digital strategy, important capabilities, and concrete action plans. We aim to transform organizations by partnering with them to build increasingly interconnected, smart systems that leverage data and enable their frontlines to deliver large and lasting impact. We develop cutting-edge solutions that include world-class digital strategy, processes, tools, and capabilities—allowing energy companies to succeed now and into the future.

To capture the benefits of digitization, mitigate threats, and take advantage of disruptions, companies need to:

- Analyze the role they will play in the digital ecosystem.

- Identify the partners they will need to work with.

- Identify and acquire the capabilities that they will need in order to succeed.

We use industry experience combined with a structured approach to enable organizations to understand how digitization can alter the industry ecosystem and define the best course of action tailored to their unique situation. We help define the digital vision, build new offerings, transform core businesses, and establish a solid foundation for full-scale digital transformation. Our holistic approach to digital transformation ensures all required dimensions are covered and no stone is left unturned when developing an organization’s path to digital success.

The Digital Deluge

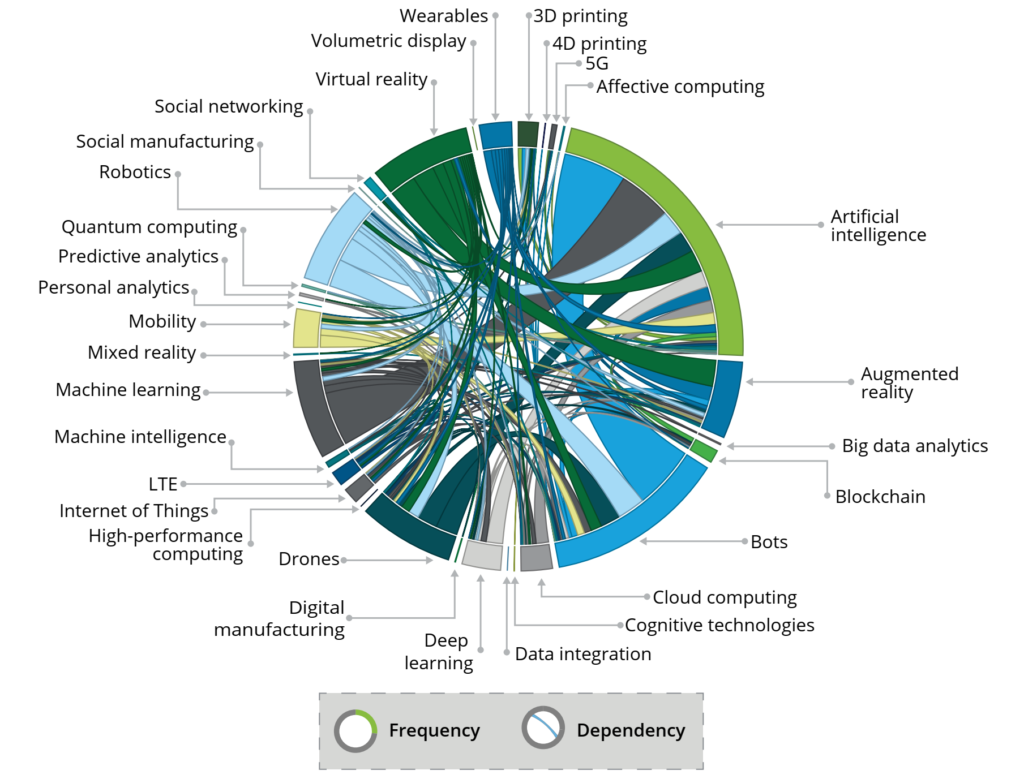

Digital technologies are helping almost every industry rewrite its operating landscape, and the O&G industry can no longer remain behind. The potential benefits of going digital are clear—increased productivity, safer operations, and cost savings. Further, for O&G players, who are already grappling with weak oil prices and moderating operational gains, one of the biggest advantages of adopting digital technology could be the resilience these technologies offer to weather the downturns that the industry is prone to. However, rapid changes in the digital world, a complex web of interdependencies between technologies, and even many names for the same technology often make it difficult for the industry to enable its digital transformation. For instance, out of the more than 200 technologies ever listed on Gartner’s Hype Cycle from 2000 to 2016, over 50 individual technologies appeared for just a single year, while many took years longer to register mainstream success.

Prominent technologies or buzzwords such as artificial intelligence and machine learning, and augmented reality and virtual reality are almost indistinguishable in terms of their benefits and highly dependent on each other. The result: high sunk and switching costs associated with technologies, siloed or marginal benefits, and nonscalable digital investments.

Although rapid prototyping (“fail early, fail fast, learn faster”) of new digital technologies is acceptable in many sectors, capital-intensive businesses such as O&G can’t solely rely on a trial-and-error approach or take a multi-technology route to address a problem. “Consumers and IT-based firms know the early bird gets the worm, but oil and gas players would rather be the second mouse that gets the cheese. This is because it’s more costly to be the first to adopt new oil and gas innovations,” says an upstream executive with a supermajor.

Further, current digital narratives in the O&G marketplace are often narrow and follow a bottomup technology language. What could help the industry is a structured, top-down approach that not only overcomes this digital deluge but also helps O&G executives to draw a comprehensive road map for company-wide digital transformation. Put simply, the approach should answer three strategic questions on digital:

- How digital are you today?,

- How digital should you become?,

- How do you become more digital?

A Step-by-Step Roadmap for Digital Transformation

Given the diverse starting points and an array of choices, O&G companies could benefit from a coherent framework that helps them achieve their near-term business objectives, measures their digital progression through stages of evolution and, above all, gives them a pathway to ultimately transform the core of their operations, the real assets and the business model itself.

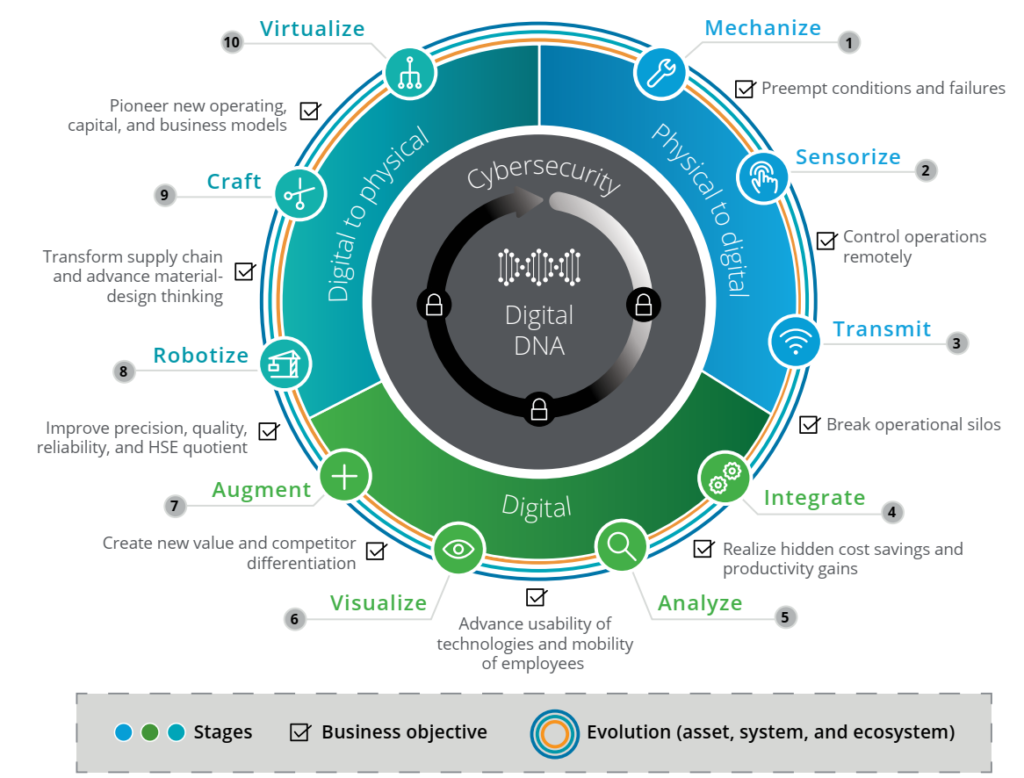

The Digital Operations Transformation (DOT) model is such a road map—a digital journey of 10 milestones, where the leap from one stage to another marks the achievement of specific business objectives, and puts cybersecurity and an organization’s digital traits at the core. Although the journey technically completes at stage 10 for a specific asset or operation, it should be broadened and extended into a never-ending loop to include a wider set of assets or business segments, the entire organization and, ultimately, the ecosystem of a company, including supply chain and external stakeholders.

First up in the journey, we have companies mechanizing the process using hydraulic, pneumatic, or electrical control systems. This can allow players to anticipate and prepare for failures and unusual conditions. The journey then progresses to capturing information from the physical world (the physical to digital realm) by sensorizing equipment and transmitting data generated in the field using IT networks. By doing this, an O&G company may be able to respond to field conditions and monitor operations remotely.

The next set of milestones can be achieved when a company breaks operational silos between disciplines, realizes hidden productivity gains, improves the usability of data, and identifies new areas of value creation. For this, the transformation should progress from integrating diverse data (using cloud-solvers, servers, data standards, etc.), analyzing and visualizing data using new-age computers and platforms (for example, big data analytics, wearables, and interactive workstations) to augmented decision-making (for example, self-learning machines).

Typically, in the O&G domain, the digital thinking and narratives stop at data-driven insights. But to become a digital leader, a company should consider making a change in its physical world by modernizing its core assets (in this case, rigs, equipment, platforms, and facilities). In other words, it should complete the last three legs of the journey from bytes to barrels by closing out the physical-digitalphysical loop.

This phase starts with robotizing facilities and progresses to the crafting of new products to improve precision, reliability, and design aspects of physical assets. Ultimately, the phase ends with virtualizing the entire asset base by creating digital twins and the digital thread, to not only extend the life of assets but also to adopt new business and asset models in the long term.7 A digital twin/thread vision would inevitably trigger the thinking and necessity to enable cross-organizational and crossvendor workflows, the biggest bottleneck for many digital transformations.

As mentioned earlier, once this physical-digital-physical loop has covered an asset, the loop can be restarted and widened to include a system of assets in a particular business line or geography, then the organization and, ultimately, the entire supply chain and external stakeholders of a company. A comprehensive cyber risk management program that is secure, vigilant, and resilient, and an organizational culture—or digital DNA—that would enable this transformation remains at the core of the model.

Digital Transformation for Upstream Operations

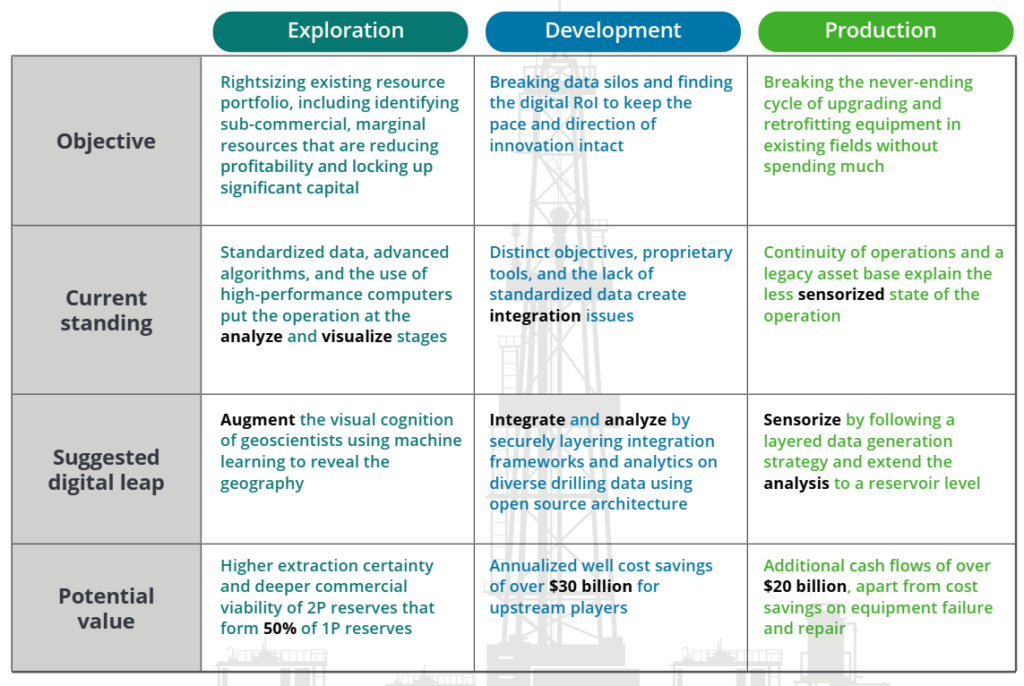

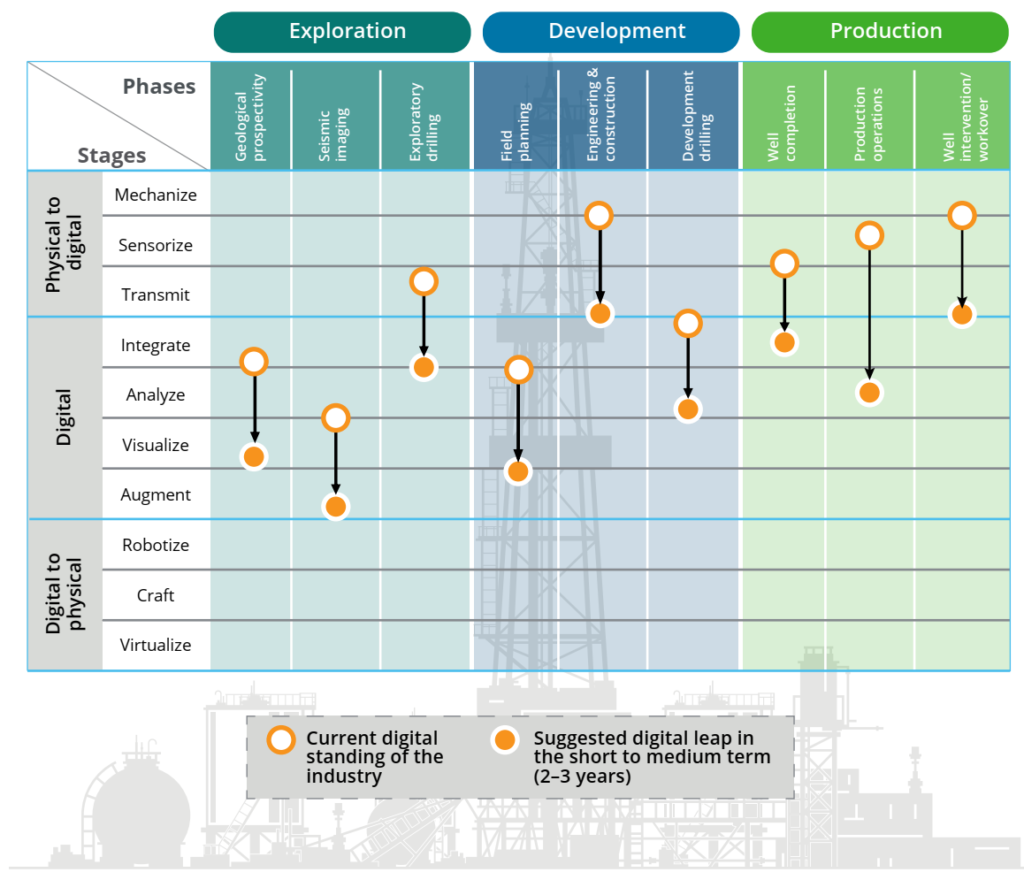

Although digital maturity varies from organization to organization, the exploration segment of the industry in general is digitally ahead of development and production. While decades of earth science understanding and advanced imaging technology have helped exploration, a complex ecosystem and a legacy asset base have constrained the digital evolution of the drilling and production segments, respectively.

However, not all subsegments within the exploration segment are ahead; similarly, there are a few subsegments within drilling and production that are adapting and getting ready for their digital leaps. The following subsegments within each segment are where either the digital transformation is most needed or has the highest value creation potential:

- seismic imaging

- development drilling

- production operations

Finally, the global market overview and the potential value of digital transformation is provided: